Exploring the impact of wartime currency on post-war economic recovery in Burma and India.

The aftermath of World War II presented significant challenges for individuals and businesses in Asia, particularly in the context of financial transactions and legal disputes. In 1945, Seethalakshmi Achi, the widow of a Nattukottai Chettiar moneylender, initiated a debt recovery case in the district court of Devakkottai, Madras. The case revolved around a loan taken by her husband, Meyappan Chettiar, from a Rangoon-based firm owned by Veerappa Chettiar. During the Japanese occupation of Burma in 1944, repayments were made towards this loan, allegedly by Meyappan Chettiar’s agent. However, a year later, Veerappa Chettiar claimed that these payments were never received and successfully sued in Madras. Seethalakshmi Achi, representing her late husband, appealed this decision to the Madras High Court, leading to a protracted legal battle that lasted six years, highlighting the complexities of wartime currency and its impact on legal contracts.

This litigation raised critical questions about the validity of the Japanese wartime currency used for repayments and the status of contracts between Indian firms and their agents in Burma, particularly as these relationships were strained by the war. The legal framework framed these issues within the context of international law, addressing the implications of wartime occupation and the status of “enemy aliens” for Indians who remained in Burma throughout the conflict. This seemingly minor debt recovery case underscored the broader difficulties faced by Indian migrants in reinvigorating capital and credit flows after the economic collapse that followed the war in South and Southeast Asia.

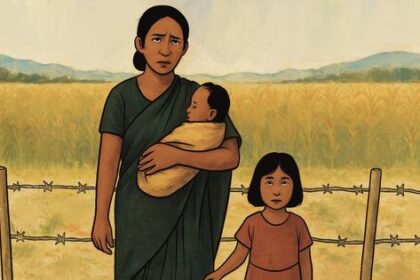

Rising tensions had been evident since the 1930s, as individuals indebted to Chettiar moneylenders often found themselves dispossessed of their collateral when unable to meet payment obligations. The prevailing sentiment against Chettiar moneylenders was exacerbated by the dominance of Indian migrant laborers in Rangoon’s industries. Consequently, there was widespread resistance to the return of foreigners to Burma after the war, prompting stringent citizenship requirements that affected travel and residence rights across newly established national borders.

The legal disputes surrounding cases like that of Seethalakshmi Achi not only reflected personal grievances but also served as a microcosm of the larger jurisdictional challenges emerging between India and Burma. Further complicating the situation were restrictions on migrant remittances and property transfers, which solidified the financial divide between the two nations. As decolonization progressed, the Nattukottai Chettiars and similar moneylenders increasingly sought legal recourse in Madras instead of Rangoon, indicating the profound impact of these financial restrictions on their operations.

The wartime disruptions had already strained financial ties between India and Burma, with Burma’s separation from India in the mid-1930s creating additional barriers to credit and capital circulation. The flight of wealth from Burma, often depicted in local newspapers as “refugee capital,” further intensified feelings of political disloyalty among displaced traders and financiers post-war. These individuals contended that their losses were a direct result of the currency changes implemented during the occupation, leading to the emergence of disputes surrounding what became known as “banana money.”

As the war concluded, it became clear to business communities, including the Chettiars, that the rampant inflation had rendered “banana money” essentially worthless, invalidating many debts. This realization triggered a cascade of legal disputes affecting a wide range of commercial transactions, from property dealings to migrant remittances, thereby threatening the stability of postwar economies. The occupation’s monetary policies had irrevocably altered the landscape of economic transactions, and the legacy of these changes would resonate long into the future as communities navigated the complexities of a recovering economic environment.